To invest in mutual funds, select a fund based on your investment goals and risk tolerance, open an account with a reputable fund house, and start investing money regularly. Investing in mutual funds is an effective way to grow your wealth and achieve your financial goals.

Mutual funds pool money from various investors to invest in a diversified portfolio of stocks, bonds, and other securities. This allows individual investors to access a professionally managed investment portfolio without the need for extensive research and expertise. When investing in mutual funds, it’s important to consider your investment goals, risk tolerance, and investment time horizon.

By selecting the right fund and consistently investing over time, you can potentially earn attractive returns and build wealth for the future.

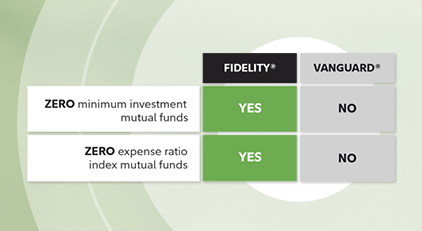

Credit: www.nerdwallet.com

Why Mutual Fund Investment Is A Smart Choice

Mutual fund investment is a smart choice due to various benefits it offers. One key advantage is diversification, which helps minimize risk. By investing in a variety of assets, such as stocks and bonds, mutual funds spread out the risk.

This means that even if one investment underperforms, the others can compensate, resulting in a balanced and potentially profitable portfolio. Furthermore, mutual funds provide access to professional fund managers who have expert knowledge of the market. These managers make informed investment decisions on behalf of investors, aiming to maximize returns.

Additionally, mutual funds offer flexibility, allowing investors to start with small amounts and add more over time. This makes them suitable for both beginners and experienced investors. With these benefits, mutual fund investment can be an effective and wise strategy for achieving long-term financial goals.

Types Of Mutual Funds And How To Choose

Mutual fund investments offer a range of options to suit different investor needs. Equity funds are ideal for long-term growth potential, as they primarily invest in stocks. These funds are subject to market risks but can deliver higher returns over time.

On the other hand, debt funds focus on fixed-income securities and offer stable returns. They are less risky compared to equity funds. Balanced funds, as the name suggests, provide a mix of growth and stability. These funds invest in a combination of stocks and bonds and are suitable for investors seeking moderate returns with lower risk.

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and time horizon. Assess the fund’s past performance, expense ratio, and fund manager’s expertise.

Step-By-Step Guide To Start Mutual Fund Investment

Investing in mutual funds can be a great way to grow your wealth over time. To get started, it’s important to set your investment goals and determine your risk tolerance. This will help you choose the right mutual fund(s) that align with your preferences and objectives.

Once you have selected the funds, you need to open a mutual fund investment account. Make sure to compare different account options and select the one that suits your needs. Next, you should invest regularly to take advantage of the power of compounding.

Set up automatic investments and monitor your portfolio regularly to ensure it stays on track. By following these steps, you can begin your mutual fund investment journey with confidence.

Tips For Successful Mutual Fund Investment

Mutual fund investment success rests on optimizing asset allocation, practicing disciplined investing, and regularly reviewing and rebalancing portfolios. By strategically allocating investments across various asset classes, risks can be mitigated, and returns can be maximized. Following a disciplined approach entails sticking to an investment plan, irrespective of market fluctuations.

Regularly reviewing and rebalancing a portfolio allows investors to realign their holdings in accordance with their investment objectives and risk tolerance. This ensures that portfolio performance remains in line with expectations. To enhance readability and engagement, it is important to use a variety of expressions throughout the content.

By adhering to these guidelines, investors can navigate the complex world of mutual fund investment with ease, achieving their financial goals.

Conclusion

Mutual fund investment can be a lucrative and reliable way to grow your wealth. By diversifying your portfolio and taking advantage of professional management, you can mitigate risk and increase your chances of earning higher returns. Remember to do thorough research and understand your risk tolerance before investing.

Stay updated with market trends, economic conditions, and industry news to make informed investment decisions. Regularly review your portfolio and make necessary adjustments to align with your financial goals. Consider consulting with a qualified financial advisor who can provide personalized guidance and support.

With discipline and patience, mutual fund investment can serve as a powerful tool in achieving your long-term financial objectives. Start investing today and unlock the potential for growth and financial independence.

More Stories

Options for Retirement Planning

How to Sip Investment